We’re getting close to applying for your first travel credit card. Before discussing your options and…

Earn Miles Instead of Interest…

There has been some discussion in the points and miles blogs about the new opportunity to earn American AAdvantage miles by opening a Bask Bank savings account.

The combination of first-year bonuses and “interest” in the form of American miles may yield a pretty good return for depositors, depending on their situation. For those of you who are familiar with Bank Direct, this is a similar proposition; both Bask and Bank Direct are subsidiaries of Texas Capital Bank and are FDIC insured.

Well, I opened a Bask Bank account but have now received an intriguing offer from Citibank with its own version of a miles-bonused savings account. The cool thing is that you can do both accounts (Citi and Bask) and collect a prodigious number of AA points over the next 15 months.

This appears to be a targeted offer for holders of the Citi/AAdvantage® Executive World Elite™ Mastercard®. I initially received an email in early February, received a screen splash when I logged into my Citi Executive account (below) and today received a snazzy four-page mailer touting the new Citi Miles Ahead™ savings account.

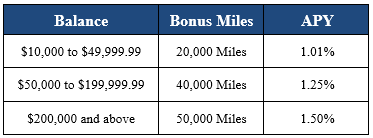

Here’s how it works. Like most savings accounts it has a variable interest rate based on the balance, which ranges from 1.01% to 1.50%. Once you open your account, you have 30 days to make a qualifying deposit. The actual interest rate you earn is based on your average daily balance.

However, the main event for most American AAdvantage miles collectors is that bonuses are paid in AA miles for maintaining balances for 90 days. Funds must be “new to Citibank” which means you can’t just move funds from an existing Citibank account to qualify.

The language is a bit ambiguous here and some parts of the offer suggest keeping a balance for 60 days will do the trick, but the customer service rep who opened my account for me said you need to maintain the opening balance for 90 days to cash in on the bonus points.

The bonuses and interest rates are as follows

So, for example, by depositing $10,000 you could snag a 20,000-mile bonus after having the account open for just 90 days and then, as I am doing, move your balance over to a Bask Bank savings account and get another bonus for maintaining a qualifying balance for 360 days.

Including the other account opening bonuses at Bask, I will have picked up 96,000 AA miles from Bask plus 40,000 miles from Citi plus about $150.00 in interest. Getting 136,000 miles for “free” isn’t a bad deal for the money I keep as my rainy-day fund. Most points and miles bloggers value American Airlines points at about 1.5¢ each, so all those miles add up to over $2,000 in travel on American.

An additional feature of the Citibank account includes receiving 25% more miles on your Citi / AAdvantage® Executive World Elite™ Mastercard® (for purchases totaling up to $50,000 per year) when you maintain at least a $10,000 balance in your Citi Miles Ahead™ savings account.

Opening the account:

I tried multiple times on several different browsers over several days to open the account online using the provided link. No luck. I would get partway through and then the rest of the application refused to load. I finally gave up and called Citi to open the account.

Here, too, I ran into some issues because there are only a handful of agents who have the training to open this special account. I tried calling the number on the back of my card and was referred to 833.940.1322 and the agent who helped me was excellent.

Is this account, or the Bask account for that matter, right for everyone? No, of course not, but if American is your go-to airline and you have the cash to do it, this makes a lot of sense. Only you can decide if the opportunity costs make it worthwhile.

As an avid traveler, Brian has explored and enjoyed cultural encounters in over 40 countries while spending many years refining The Points Game — using credit card sign-up bonuses and other tricks to get nearly free travel. Getting the most out of every trip is an art and Brian launched My Travel Traxx to help others enjoy the art of travel.

Comments (0)