OK… you’ve done your Points Game 101 homework and you now have a pretty good idea…

The Points Game 103: A Word About Credit…

We’re getting close to applying for your first travel credit card. Before discussing your options and zeroing in on the cards you should be acquiring, we need to have a serious, in-depth discussion about credit; what it is, how applying for cards impacts your credit and how to manage your credit in the long term. Let’s get started.

Important Disclaimer

Before we delve into this topic, I need to provide a disclaimer/warning. Despite my 16 years working for Bank of America, I am not a credit expert. My credit card expertise comes from my own experiences and reading everything I can get my hands on.

While I supervised associates involved with the bank’s mortgage and credit card business, I was not certified in extending credit. In other words, do your own research regarding managing credit. I have done a lot of studying in this area but laws, regulations and situations change, so you need to conduct your own due diligence based on your individual circumstances.

There are plenty of ways to educate yourself on credit usage, but I highly recommend the Experian website for a concise, easy-to-understand discussion of credit and how to handle it. Also, check out your bank’s website or those of the credit cards you already have; they often have excellent tutorials on credit management.

What Is Credit?

At its most basic level, credit is just an agreement in which one party borrows something of value in return for repaying the lender the initial amount plus some consideration. In the case of a credit card, you make a purchase by using the lender’s money in the short term with a contractual obligation to repay the amount of the purchase plus interest or fees.

If you’re smart — and this is the only way to manage a credit card — you’ll pay the amount you have borrowed in full each month. If you carry a balance, you will not only pay interest on the amount left unpaid from one month to the next but this can impact your credit score as you’ll see below.

Many cards we’ll be applying for have an annual fee that helps cover the cost of extending credit plus the various benefits the card offers. I can hear it now. “Brian – why would I want to pay a fee for a credit card when I can get a no-fee card instead.” A perfect example of why paying a fee can be a good value is my wife’s Marriott card.

The Amex Business Marriott card comes with a $125 annual fee but offers a number of benefits such as an extended warranty on all purchases, no foreign exchange fees if using it abroad, CDW waiver for car rentals, a limited travel insurance benefit and, most importantly, one free night each year.

That last item more than covers the cost of the annual fee. We’ve used that free night certificate to book a room at the JW Marriott in Panama City, which at the time was going for over $200 per night.

How is my credit score calculated?

There are three main credit reporting agencies: Experian, TransUnion and Equifax. While each of these three calculate your score using slightly different methods, the standard is set by Fair Isaac Corporation (FICO).

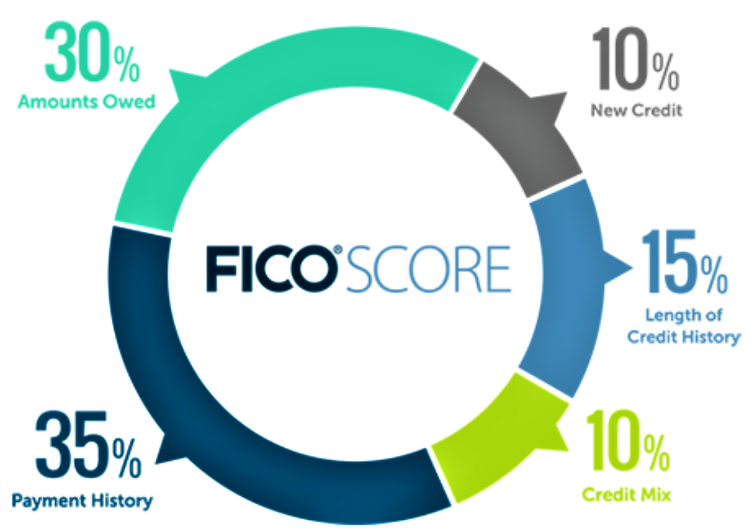

There are multiple FICO scores; some are generated specifically for auto loans, mortgages, credit cards and other lending. The score we are interested in when applying for credit cards is the FICO 8 score. The website myFICO uses this graphic to explain how that score is calculated:

Nearly two-thirds of that score is based on your payment history and the balances you carry. Payment History is obvious – always make your payment on time even if it is the minimum!!!

When reading the fine print on a card application you’ll notice the APR can often be in the 25% range. I couldn’t care less what the interest rate is because I always pay on time and in full and you should too.

As I noted in The Points Game Intro: The Adventure Begins, if you have a hard time managing your credit card spend you should click out of this post and ignore this part of the blog; there are big benefits to playing The Points Game, but you need to be highly disciplined and keep track of your spending and payment dates.

The Amounts Owed category is a bit trickier because it’s really a reflection of credit utilization. So, if you have a home equity line of credit for $85,000 and three credit cards each with a $5,000 credit line, the total amount of credit you could potentially use would be $100,000. If you have $7,000 outstanding on your HELOC and $1,000 each on your credit cards, your total credit utilization would be $10,000 or 10%.

The lower that number is, the more likely this component of your credit score will be positive. The more credit utilized the more a lender gets shy about extending you more credit because they begin to see you as a risk.

It is generally recommended that your Amounts Owed category be kept under 30%, but to achieve a high credit score you should aim to keep it under 6%. When you think about it, the more credit cards you have, the easier it is to keep this score low because your credit line continues to grow while your spending is likely to remain fairly static.

Length of Credit History takes into account how long your existing credit lines have been open including the age of your oldest account, an average of all of your accounts and the age of your newest account. For this reason, I suggest that folks (especially younger people) open a couple of no-fee credit cards and hang on to them forever.

Some credit card companies will close unused credit lines because there is a cost to keeping them open. As a result, I make sure to use every card I have at least two or three times per year, even if it is just a $10 charge.

Although these aren’t no-fee cards, I have a personal Amex card that was opened in 1996 and a business Citibank American Airlines card that was opened in 2001. Those two cards help keep the average of my credit lines down and I will probably never close them.

Opening and closing cards willy nilly just to get airline or hotel points can hurt your score. In addition, some credit card companies have been clawing back the bonus points you earned if you close the card before one year is up in an attempt to avoid the annual fee. You need a plan to manage this portion of your score.

The New Credit part of your score can be impacted if you open too many credit accounts over a short period of time. In my experience, this drop in your score when opening new accounts is generally temporary and your score will usually rebound within a few months. That said, many card companies pay particular attention to this aspect even if you have a score over 800.

Finally, the Credit Mix refers to the blend of revolving and installment accounts that you have. I don’t have any installment accounts (mortgage, auto loan, HELOC, student loan) so my score may be impacted slightly but not enough to worry about. As noted above, Payment History and Amounts Owed are the two most critical elements of your FICO score. Again, the myFICO website is an excellent source for understanding your score.

Know your credit before you apply.

Start by going to AnnualCreditReport.com and order your three credit reports. By law, you are entitled to a free report from Experian, TransUnion and Equifax once per year. Although you would normally be charged a fee for ordering a report more than once per year, all three agencies have committed to providing free weekly online reports through April, 2021.

Be aware that getting your three reports does not provide your credit score. There may be a charge for that or the credit cards you already have may provide one of the scores for free. Your credit score will help determine which cards to apply for, so make sure to acquire them.

When researching for this post I pulled all three of my reports. I paid TransUnion $ .99 for my FICO score, Equifax was free and my Experian score I pulled from one of my credit cards.

Your scores will not all be the same because not every creditor regularly reports to all three reporting agencies. For example, my recent scores varied by 18 points. If I had a score that was significantly outside the range of the other two, I would do a deep dive into that credit report to see if there was some misreporting that needed correction.

Take the time to review your three reports. The three reports are arranged very differently and that can be frustrating, but here is the type of information you’ll find:

- A summary of each open account.

- If you’ve had an account that has been charged off, foreclosed, a repossession, collection, 30-60-90-120-days late summary.

- A list of all “hard” credit inquiries made over the last two years.

- A list of “soft” inquiries made by insurance companies, employers, collection companies (these are not used to develop your credit score).

- Whether or not you have placed a freeze on your report.

So, what is a “good” score?

Remember, your FICO credit score is a reflection of how risky it is for a bank to extend credit to you. In general, applying for affinity credit cards that will provide a sign-up bonus of points you can use for travel will require a Good score (670 – 739), Very Good (740 – 799) or Exceptional (800+) credit score. Lower scores may still get a card issued but with a smaller credit line.

If your score is under 670, you may not qualify for a points-bearing card but don’t despair. There are ways you can improve that score and I will address that in a separate post.

When you start actively participating in The Points Game, there are some credit security precautions you should take that, quite frankly, I think everyone should do.

Freeze your credit reports.

Freezing your report keeps anyone from accessing your information and significantly reduces the likelihood that someone can open a credit account in your name without your knowledge. All three reporting agencies offer this service for free and you can place the freeze using these links: Experian, TransUnion, Equifax

Note that there is a difference between a freeze and a lock. Placing and lifting a freeze is free; a lock is a similar service provided by the three agencies but at a price because it is part of a package of “benefits.” Whether you go the route of a freeze or a lock, you’ll need to temporarily lift the freeze or lock so the bank can access your report and score when you submit an application.

A few final notes.

In general, business credit cards are not reported on your personal credit report. Even if you acquire the card for a sole proprietorship using your Social Security number, in most cases it will not be included on your personal credit report.

I am a fan of credit monitoring. I use Experian, but Lifelock or any of the other major credit monitoring services should be good. Let’s face it… you’re busy. The key here is that you have a second set of eyes reviewing your credit activity to make sure your credit history is not impacted by bad actors.

OK… you should be used to this by now so here is your Homework Assignment:

- Get and analyze your credit reports. If you find an error, use the information provided to file a correction request.

- Get all three of your credit scores.

- If you’re under the age of 60, consider getting one or more no-fee credit cards that you will hold forever.

- Go online and review the benefits of each of your current credit cards.

- Place a freeze on each of the three credit reports.

One last item. if you are in the process or planning to apply for a larger loan, like a mortgage or car loan, it is best to hold off on credit card applications until that process is complete.

As an avid traveler, Brian has explored and enjoyed cultural encounters in over 40 countries while spending many years refining The Points Game — using credit card sign-up bonuses and other tricks to get nearly free travel. Getting the most out of every trip is an art and Brian launched My Travel Traxx to help others enjoy the art of travel.

This Post Has 0 Comments