We’re getting close to applying for your first travel credit card. Before discussing your options and…

Earn American Airline Miles With a Bask Bank Account…

We talk a lot about using credit card sign-up bonuses to collect frequent flyer miles and hotel points by playing The Points Game. But what if there were a way to earn by NOT spending money? What if you could earn airline miles while you sleep? Sound intriguing?

FDIC-insured Bask Bank offers a savings account that earns American Airlines AAdvantage miles instead of interest. The Bask Savings Account awards one AAdvantage mile for each dollar saved annually. Given that the highest annual percentage yield on Bankrate.com today is offering .91%, earning AA points is a good deal.

Here’s how it works.

According to their FAQ, each month your American Airlines AAdvantage account will be credited with “interest” in the form of AA miles which is based on an annual average balance. For example, if the account’s average monthly balance for January is $20K, you will earn 1,698 AAdvantage miles for that month ($20K ÷ 365 days in the year × 31 days in January).

If that same balance is maintained in February, you will earn 1,534 AAdvantage miles and so on. After one year of maintaining an average balance of $20,000, you will have earned 20,000 AAdvantage miles. Not bad! Get started by opening an account online HERE.

In addition to earning miles each month, there are also bonus miles to be made for opening the account and maintaining minimum balances. First, there is an account opening bonus. Maintain a minimum balance of $5,000 for 90 days within 120 days of account opening for accounts opened before December 31, 2020, and you’ll pick up a 1,000-point bonus.

Read Related: Earning Miles Instead of Interest…

Alternatively, if you deposit at least $10,000 into your new Bask Savings Account using the offer link on this page and hold that balance for 90 days within the first 120 days of opening your account, you’ll earn 5,000 AAdvantage bonus miles (accounts must be opened before September 30, 2020).

What can you do with 20,000 miles?

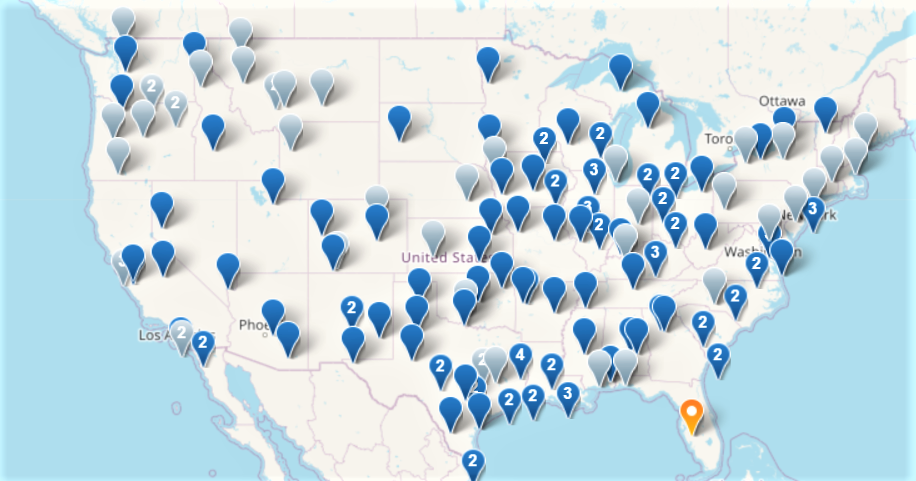

Let’s say I wanted to take advantage of the MLK weekend by flying out on January 16 and returning January 23. The wife and I could head to Vegas to see a few shows for 20K roundtrip from our home airport of Sarasota, or I could fly solo and do some skiing at Big Sky in Montana for 17.5K roundtrip. The cash price to Vegas would be $527 and $331 to Bozeman. The dark blue markers on the American Airlines Award Map below shows all the locations you can go roundtrip for only 10K miles.

Why earn miles instead of interest?

Assume you find a savings account or money market account that earns a whopping 1.0% instead of the 0.91% I found at Bankrate.com. Over the course of a year, you would earn $24.00 in interest. As you can see above, 20,000 points are worth a lot more than $24.

Most travel blog sites that set a value for the various airline, hotel and reward card points fix the value of one American Airlines AAdvantage mile at $ 0.015. So, a ballpark value for 20,000 miles can be calculated to be about $300.

Is there a downside?

Like any savings account, interest earned is reported to the IRS and you will receive a 1099-Int. Historically, the amount reported will be about $ .004 per mile. So, sticking with our $20,000 account balance, you would receive a 1099-Int for roughly $80.

Assuming that you are in a 30% tax bracket, the cost for those 20,000 American Airlines miles will be $56 plus any opportunity costs for not investing the funds elsewhere. If you’re like me, you set aside some “rainy day” money in case the sky falls. I figure I might as well earn miles I can travel with while that money is just sitting there.

This is a bare-bones account. They do not offer an ATM card and at this point, they don’t offer a joint account (although you can assign a beneficiary). But then what did you expect from an account that has no account fees or minimum balance? That’s right – no fees. We’ve gotten used to many of the big banks charging us a monthly fee for the privilege of depositing our money with them, but no so with Bask Bank.

What are you waiting for? Apply HERE today!

As an avid traveler, Brian has explored and enjoyed cultural encounters in over 40 countries while spending many years refining The Points Game — using credit card sign-up bonuses and other tricks to get nearly free travel. Getting the most out of every trip is an art and Brian launched My Travel Traxx to help others enjoy the art of travel.

Comments (0)